My first reaction when I heard that Michael Lewis had been embedded with Sam Bankman-Fried working on a book when Bankman-Fried's cryptocurrency exchange FTX collapsed into bankruptcy after losing billions of dollars of customer deposits was "holy shit, why would you talk to Michael Lewis about your dodgy cryptocurrency company?" Followed immediately by "I have to read this book."

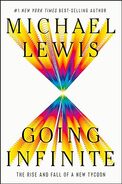

This is that book.

I wasn't sure how Lewis would approach this topic. His normal (although not exclusive) area of interest is financial systems and crises, and there is lots of room for multiple books about cryptocurrency fiascoes using someone like Bankman-Fried as a pivot. But Going Infinite is not like The Big Short or Lewis's other financial industry books. It's a nearly straight biography of Sam Bankman-Fried, with just enough context for the reader to follow his life.

To understand what you're getting in Going Infinite, I think it's important to understand what sort of book Lewis likes to write. Lewis is not exactly a reporter, although he does explain complicated things for a mass audience. He's primarily a storyteller who collects people he finds fascinating. This book was therefore never going to be like, say, Carreyrou's Bad Blood or Isaac's Super Pumped. Lewis's interest is not in a forensic account of how FTX or Alameda Research were structured. His interest is in what makes Sam Bankman-Fried tick, what's going on inside his head.

That's not a question Lewis directly answers, though. Instead, he shows you Bankman-Fried as Lewis saw him and was able to reconstruct from interviews and sources and lets you draw your own conclusions. Boy did I ever draw a lot of conclusions, most of which were highly unflattering. However, one conclusion I didn't draw, and had been dubious about even before reading this book, was that Sam Bankman-Fried was some sort of criminal mastermind who intentionally plotted to steal customer money. Lewis clearly doesn't believe this is the case, and with the caveat that my study of the evidence outside of this book has been spotty and intermittent, I think Lewis has the better of the argument.

I am utterly fascinated by this, and I'm afraid this review is going to turn into a long summary of my take on the argument, so here's the capsule review before you get bored and wander off: This is a highly entertaining book written by an excellent storyteller. I am also inclined to believe most of it is true, but given that I'm not on the jury, I'm not that invested in whether Lewis is too credulous towards the explanations of the people involved. What I do know is that it's a fantastic yarn with characters who are too wild to put in fiction, and I thoroughly enjoyed it.

There are a few things that everyone involved appears to agree on, and therefore I think we can take as settled. One is that Bankman-Fried, and most of the rest of FTX and Alameda Research, never clearly distinguished between customer money and all of the other money. It's not obvious that their home-grown accounting software (written entirely by one person! who never spoke to other people! in code that no one else could understand!) was even capable of clearly delineating between their piles of money. Another is that FTX and Alameda Research were thoroughly intermingled. There was no official reporting structure and possibly not even a coherent list of employees. The environment was so chaotic that lots of people, including Bankman-Fried, could have stolen millions of dollars without anyone noticing. But it was also so chaotic that they could, and did, literally misplace millions of dollars by accident, or because Bankman-Fried had problems with object permanence.

Something that was previously less obvious from news coverage but that comes through very clearly in this book is that Bankman-Fried seriously struggled with normal interpersonal and societal interactions. We know from multiple sources that he was diagnosed with ADHD and depression (Lewis describes it specifically as anhedonia, the inability to feel pleasure). The ADHD in Lewis's account is quite severe and does not sound controlled, despite medication; for example, Bankman-Fried routinely played timed video games while he was having important meetings, forgot things the moment he stopped dealing with them, was constantly on his phone or seeking out some other distraction, and often stimmed (by bouncing his leg) to a degree that other people found it distracting.

Perhaps more tellingly, Bankman-Fried repeatedly describes himself in diary entries and correspondence to other people (particularly Caroline Ellison, his employee and on-and-off secret girlfriend) as being devoid of empathy and unable to access his own emotions, which Lewis supports with stories from former co-workers. I'm very hesitant to diagnose someone via a book, but, at least in Lewis's account, Bankman-Fried nearly walks down the symptom list of antisocial personality disorder in his own description of himself to other people. (The one exception is around physical violence; there is nothing in this book or in any of the other reporting that I've seen to indicate that Bankman-Fried was violent or physically abusive.) One of the recurrent themes of this book is that Bankman-Fried never saw the point in following rules that didn't make sense to him or worrying about things he thought weren't important, and therefore simply didn't.

By about a third of the way into this book, before FTX is even properly started, very little about its eventual downfall will seem that surprising. There was no way that Sam Bankman-Fried was going to be able to run a successful business over time. He was extremely good at probabilistic trading and spotting exploitable market inefficiencies, and extremely bad at essentially every other aspect of living in a society with other people, other than a hit-or-miss ability to charm that worked much better with large audiences than one-on-one. The real question was why anyone would ever entrust this man with millions of dollars or decide to work for him for longer than two weeks.

The answer to those questions changes over the course of this story. Later on, it was timing. Sam Bankman-Fried took the techniques of high frequency trading he learned at Jane Street Capital and applied them to exploiting cryptocurrency markets at precisely the right time in the cryptocurrency bubble. There was far more money than sense, the most ruthless financial players were still too leery to get involved, and a rising tide was lifting all boats, even the ones that were piles of driftwood. When cryptocurrency inevitably collapsed, so did his businesses. In retrospect, that seems inevitable.

The early answer, though, was effective altruism.

A full discussion of effective altruism is beyond the scope of this review, although Lewis offers a decent introduction in the book. The short version is that a sensible and defensible desire to use stronger standards of evidence in evaluating charitable giving turned into a bizarre navel-gazing exercise in making up statistical risks to hypothetical future people and treating those made-up numbers as if they should be the bedrock of one's personal ethics. One of the people most responsible for this turn is an Oxford philosopher named Will MacAskill. Sam Bankman-Fried was already obsessed with utilitarianism, in part due to his parents' philosophical beliefs, and it was a presentation by Will MacAskill that converted him to the effective altruism variant of extreme utilitarianism.

In Lewis's presentation, this was like joining a cult. The impression I came away with feels like something out of a science fiction novel: Bankman-Fried knew there was some serious gap in his thought processes where most people had empathy, was deeply troubled by this, and latched on to effective altruism as the ethical framework to plug into that hole. So much of effective altruism sounds like a con game that it's easy to think the participants are lying, but Lewis clearly believes Bankman-Fried is a true believer. He appeared to be sincerely trying to make money in order to use it to solve existential threats to society, he does not appear to be motivated by money apart from that goal, and he was following through (in bizarre and mostly ineffective ways).

I find this particularly believable because effective altruism as a belief system seems designed to fit Bankman-Fried's personality and justify the things he wanted to do anyway. Effective altruism says that empathy is meaningless, emotion is meaningless, and ethical decisions should be made solely on the basis of expected value: how much return (usually in safety) does society get for your investment. Effective altruism says that all the things that Sam Bankman-Fried was bad at were useless and unimportant, so he could stop feeling bad about his apparent lack of normal human morality. The only thing that mattered was the thing that he was exceptionally good at: probabilistic reasoning under uncertainty. And, critically to the foundation of his business career, effective altruism gave him access to investors and a recruiting pool of employees, things he was entirely unsuited to acquiring the normal way.

There's a ton more of this book that I haven't touched on, but this review is already quite long, so I'll leave you with one more point.

I don't know how true Lewis's portrayal is in all the details. He took the approach of getting very close to most of the major players in this drama and largely believing what they said happened, supplemented by startling access to sources like Bankman-Fried's personal diary and Caroline Ellis's personal diary. (He also seems to have gotten extensive information from the personal psychiatrist of most of the people involved; I'm not sure if there's some reasonable explanation for this, but based solely on the material in this book, it seems to be a shocking breach of medical ethics.) But Lewis is a storyteller more than he's a reporter, and his bias is for telling a great story. It's entirely possible that the events related here are not entirely true, or are skewed in favor of making a better story. It's certainly true that they're not the complete story.

But, that said, I think a book like this is a useful counterweight to the human tendency to believe in moral villains. This is, frustratingly, a counterweight extended almost exclusively to higher-class white people like Bankman-Fried. This is infuriating, but that doesn't make it wrong. It means we should extend that analysis to more people.

Once FTX collapsed, a lot of people became very invested in the idea that Bankman-Fried was a straightforward embezzler. Either he intended from the start to steal everyone's money or, more likely, he started losing money, panicked, and stole customer money to cover the hole. Lots of people in history have done exactly that, and lots of people involved in cryptocurrency have tenuous attachments to ethics, so this is a believable story. But people are complicated, and there's also truth in the maxim that every villain is the hero of their own story. Lewis is after a less boring story than "the crook stole everyone's money," and that leads to some bias. But sometimes the less boring story is also true.

Here's the thing: even if Sam Bankman-Fried never intended to take any money, he clearly did intend to mix customer money with Alameda Research funds. In Lewis's account, he never truly believed in them as separate things. He didn't care about following accounting or reporting rules; he thought they were boring nonsense that got in his way. There is obvious criminal intent here in any reading of the story, so I don't think Lewis's more complex story would let him escape prosecution. He refused to follow the rules, and as a result a lot of people lost a lot of money. I think it's a useful exercise to leave mental space for the possibility that he had far less obvious reasons for those actions than that he was a simple thief, while still enforcing the laws that he quite obviously violated.

This book was great. If you like Lewis's style, this was some of the best entertainment I've read in a while. Highly recommended; if you are at all interested in this saga, I think this is a must-read.

Reviewed: 2023-10-24